unrealized capital gains tax california

March 26 2022 229 PM PDT. Depending on what type of investments you have in the HSA you will have the possibility of interest dividends qualifying or ordinary and capital gains.

Taxing Unrealized Capital Gains A Bad Idea National Review

Im seeing other internet articles that state that unrealized gains within the HSA are NOT taxed in CA only actual gains like dividends that are paid out capital gains if a mutual fund is sold etc.

. Taxing unrealized Capital gains on the value of securities is rich. For tax year 2021 returns filed in 2022 all the unrealized capital gains of billionaires would be deemed realized using market values as of April 1 2021 and would face the top tax rate on capital gains that applies for tax year 2022. National Investment Income Tax 38.

If that phrase. It would impose significant tax liability when first implemented as taxpayers would be required to pay taxes on. A tax on unrealized gains would punish taxpayers for past decision making by taxing paper gains from the original date that asset was acquired.

Unrealized Capital Gains Tax Commit to Equity Coalition Demands CA Billionaire Tax Millionaire Tax and Additional Tax on Stock Gains August 20 2020 723 pm August 20 2020 723 pm. And the value of their unrealized gains differs significantly about 100000 for the bottom 20 versus 17 million for the top 10 on average according to the federal reserve. Actually good point.

Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent. Bidens proposed wealth tax styled as a minimum income tax on households worth more than 100 million will claim at least 20 of both income and unrealized capital gains. High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408.

While some individuals can see Californias lowest capital gains rate the average for investors and other passive income from capital gains rates is the higher percentage of 13. Robert Schlie Getty Images. Total long term capital.

In reality it is a tax on wealth. This tax is just the latest attempt by the Democrats to reshape the tax code and pass a tax on unrealized gains. How to report Federal return.

Federal long term capital gain rate 396 BidenYellen proposal v 20 today. Total long term capital gain rate 567. In addition to taxing unrealized gains at death the AFP would raise the top marginal capital gains tax rate for taxpayers earning over 1 million to 434 percent when including the 38 percent net investment income tax NIIT considerably higher than the current top capital gains tax rate of 238 percent.

A Texas resident would see the following taxes. National Investment Income Tax 38. The first of these is a proposal to implement a so-called mark-to-market regime for taxing unrealized capital gains.

The Sacramento Capital. Capital gains tax could be applied to the value of securities portfolios owned by the ultra wealthy. Unrealized Capital Gains Tax CaliforniaCalifornia does not have a lower rate for capital gains.

This tax called a billionaire minimum income tax would impose an annual 20 percent tax on taxpayers with income and assets that exceeding 100 million a 360 billion tax increase. California long term capital gain rate 133. Unrealized Capital Gains Tax Capital Gains Tax Rate 2022 It is widely believed that capital gains are the result of earnings made through the sale an asset such as stocks real estate stock or a company and that these profits constitute taxable income.

When it comes down to determining the amount you have to pay tax on these gains a lot depends on the. If you have a difference in the treatment of federal and state capital gains file. Therefore California treats an HSA like an ordinary investment account.

California does not have a lower rate for capital gains. Households worth more than 100 million as. Bidens proposed wealth tax styled as a minimum income tax on households worth more than 100 million will claim at least 20 of both income and unrealized capital gains.

Tax rates may vary as low as 1 or as high as 13 depending on the source of the capital gains and an individuals tax bracket. If an asset is projected to make money but you dont cash in on that profit its an unrealized gain. President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US.

Thus capital gains and losses are reported in the year in which the investment fund buys or sells the underlying stocks or bonds or funds. To report your capital gains and losses use US. Individual Income Tax Return IRS Form 1040 and Capital Gains and Losses Schedule D IRS Form 1040.

Of assets through marking to. To push tax increases in the California Legislature. 30 2021 Published 1040 am.

What Does the Proposal To Tax Unrealized Capital Gains Mean for Americans. This new tax is similar to the wealth taxes pushed by radical. 5 This is presumed to be 396 if.

If that phrase. You may have to call the HSA administrator and ask if the net investment gains is capital gains. Unrealized Capital Gains Tax.

Anyone else care to chime in. Texas long term capital gain rate 0. A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income.

In California HSA accounts are treated as a normal investment account. All capital gains are taxed as ordinary income.

Understanding The California Capital Gains Tax

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

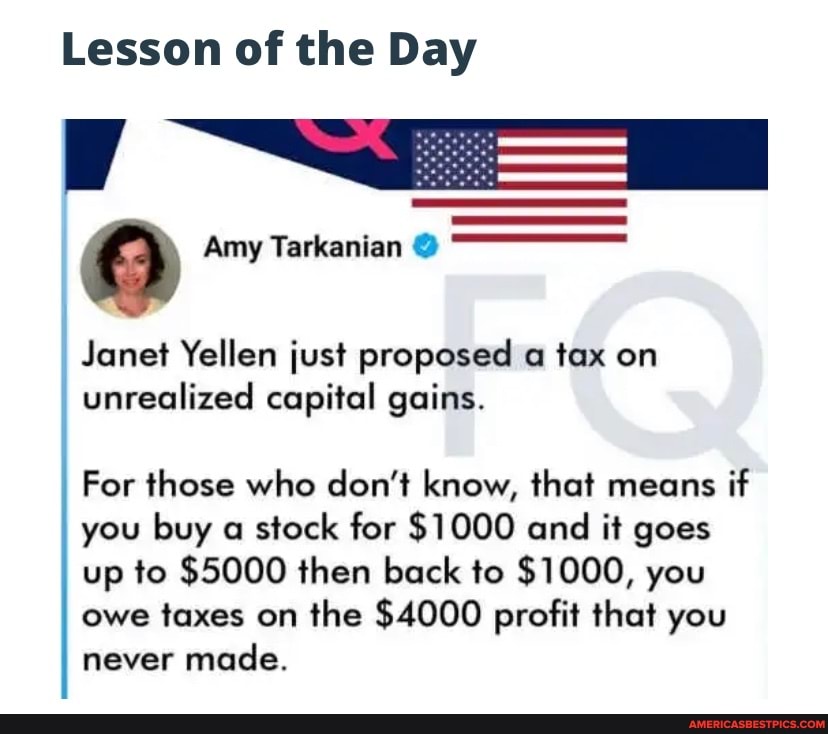

Lesson Of The Day Amy Tarkanian Janet Yellen Just Proposed A Tax On Unrealized Capital Gains

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Dems Latest Idea To Fund Their Spendapalooza As Desperate As It Gets

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Net Unrealized Appreciation Bogart Wealth

Search Search Home About Our Experts Our Achievements Events Subscriptions What S New National Security Health Care Health Care Publications Health Care Commentaries Health Care Newsletters Kellye Wright Fellowship Health Policy Blog Taxes

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

The Unintended Consequences Of Taxing Unrealized Capital Gains

Capital Gains Tax Calculator 2022 Casaplorer

The Trouble With Unrealized Capital Gains Taxes The Spectator World

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)