maryland student loan tax credit 2021

CuraDebt is a company that provides debt relief from Hollywood Florida. The Student Loan Debt Relief Tax Credit is a program.

Can I Get A Student Loan Tax Deduction The Turbotax Blog

To be eligible you must claim Maryland residency for the 2021 tax year file 2021 Maryland state income taxes have incurred at least 20000 in undergraduate.

. Maryland student loan tax credit 2021. We are aware that student loan debt has become a growing concern among college graduates and wanted to remind you of a tax credit that you may be able to take advantage of. About the Company 2021 Student Loan Debt Relief Tax Credit Maryland.

The credit amount is limited to the lesser of the individuals state tax liability for that year of the maximum allowable credit of 5000 per owner who qualifies to claim the credit. It was founded in 2000 and has since become an active member of the American Fair Credit Council the US Chamber of Commerce and is accredited by the International Association of Professional Debt Arbitrators. Commission MHEC provides an income tax credit for Maryland residents making eligible undergraduate andor graduate education payments on loans from an accredited college or university.

The Maryland Higher Education Commission MHEC is continuing their Student Loan Debt Relief Tax Credit for 2021. The credit can be claimed on Maryland forms 502 504 505 or 515. For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will get a 200 refund.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. The Student Loan Debt Relief Tax Credit is a program created under 10. Complete the Student Loan Debt Relief Tax Credit application.

From July 1 2022 through September 15 2022. The tax credits were divided into two groups of eligibility including Maryland residents who attended a Maryland institution and Maryland residents who attended an out-of-state institution. Increasing from 9000000 to 100000000 the total amount of tax credits that the Maryland Higher Education Commission may approve in a taxable year.

The Student Loan Debt Relief Tax Credit Program for Tax Year 2020 is Closed STUDENT LOAN DEBT RELIEF TAX CREDIT. The new stimulus bill signed on December 21 2020 extends the ability for employers to make tax-free student loan repayment contributions for employees until 2025. CuraDebt is a debt relief company from Hollywood Florida.

The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. CuraDebt is a company that provides debt relief from Hollywood Florida. 18 rows Form to be used when claiming dependents.

If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference. Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain amount of student loan debt may claim against the State income tax. About the Company Student Loan Debt Relief Tax Credit Maryland 2021.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. In 2021 9155 Maryland residents received the Student Loan Debt Relief Tax Credit. Student Loan Debt Relief Tax Credit for Tax Year 2021.

Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and Currently owe at least a 5000 outstanding student loan debt balance. INACCURATE CREDIT REPORTING The Student Loan Servicing Bill of Rights enacted in 2019 makes it a violation of Maryland law for a student loan servicer to knowingly or recklessly provide inaccurate information to a consumer reporting agency or refuse to correct inaccurate information provided to a. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit.

It was established in 2000 and has since become an active participant in the American Fair Credit Council the US Chamber of Commerce and accredited through the International Association of Professional Debt. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. Enter the total level of tax credit up to 5000 being claimed based upon the total eligible undergraduate student loan debt balance as of submission of the tax credit application.

Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. As with other forms of employer-provided educational assistance previously included in the law the amount of the payments is capped at 5250 per year per employee and is excluded from the.

Payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a Form 502 or Form 505 estimated tax payments or extension payments. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. April 16 2021 by Leave a Comment.

About the Company How To Claim Maryland Student Loan Debt Relief Tax Credit. It was established in 2000 and is a member of the American Fair Credit Council the US Chamber of Commerce and has been accredited by the International Association of Professional Debt Arbitrators. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit.

CuraDebt is a company that provides debt relief from Hollywood Florida. There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit. There were 5145 applicants who attended in-state institutions and will.

Currently owe at least a 5000 outstanding student loan debt balance. This tax credit is given to help students offset some of. Those who attended in-state institutions received 1067 in tax credits while eligible applicants who attended.

Detailed EITC guidance for Tax Year. About the Company Student Loan Debt Relief Tax Credit 2021 Maryland. Personal Tax Payment Voucher for Form 502505 Estimated Tax and Extensions.

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents Tax Year 2021 Only Instructions. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe. About the Company Maryland Student Loan Tax Relief Credit.

It was established in 2000 and is an active member of the American Fair Credit Council the US Chamber of Commerce and is accredited with the International Association of Professional Debt Arbitrators. It was established in 2000 and has been an active part of the American Fair Credit Council the US Chamber of Commerce and is accredited with the International Association of Professional Debt Arbitrators. Please note that the full amount of the tax credit will have to be used to pay down your undergraduate student loan debt in the next 24 months.

Nikola Tesla On Hundred Dinars Serbian Money Serbian Dinar Bill Of A Hundred D Sponsored Dinars Serbian Nikola Tesla Nikola Tesla Tesla Serbian

Free 65 Application Forms In Ms Word Pdf Google Docs Pages Business Venture Application Form Application

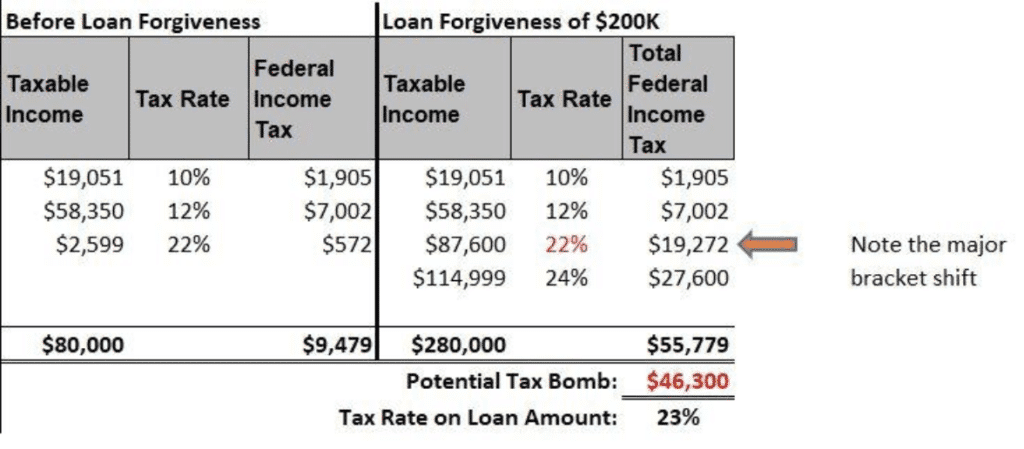

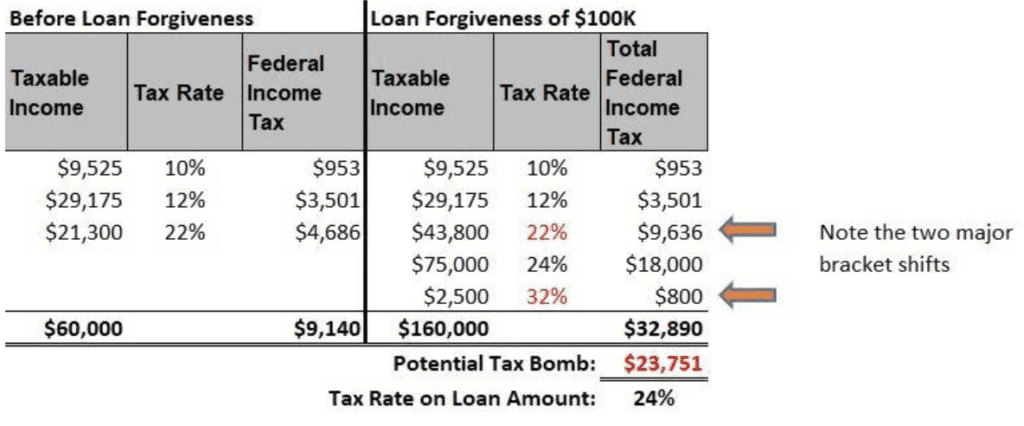

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Pin By Military Benefits On Money Finance In 2021 Military Benefits Sea Career

Is Student Loan Forgiveness Taxable In 2022 It S Complicated

Best Ira Rollover Promotions See 5 Brokers That Pay You To Rollover Your Ira Cash Management Ira Stock Broker

What Is The 2020 Form 1040 Filing Taxes Deferred Tax Tax Forms

Learn How The Student Loan Interest Deduction Works

Usda Loan Eligibility Raleigh Nc First Time Home Buyers Usda Loan Raleigh Loan

Infographic Big Ways For Small Businesses To Save Small Business Tax Deductions Small Business Tax Business Tax

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Pimd Tests Out The Strategy Of Investing In One Real Estate Property Each Year And Models The Cash Flo Real Estate Investing Investing For Retirement Investing

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Get Latest News Headlines Breaking News And Updates Of Local National And International Origin With Art Latest News Headlines News India Pollution Prevention

Community Program Budget How To Create A Community Program Budget Download This Community Program Budget Template Budget Template Budgeting Community Grants